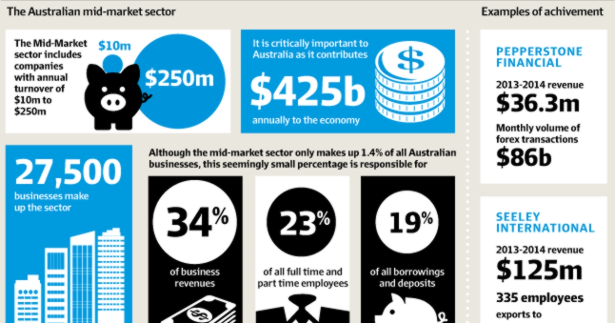

1.4% of businesses, 34% of revenue: why the medium-sized company sector is finally getting noticed

Turn over less than $10 million a year, and your enterprise is defined as a small business. There were more than 2 million of those at the last count by The Australian Bureau of Statistics, so collectively you’re part of a powerful and much-romanticised lobby. You even have your own cabinet minister.

Turn over more than $250 million, meanwhile, and you can throw your weight around within the Business Council Of Australia or the Australian Chamber Of Commerce & Industry. Regardless, call the local member wherever you have a presence, and they’ll call you back.

But for the businesses between these two extremes? Mid-sized companies have for too long been reduced to the “M” in “SME” in the policy debate, where the emphasis has really been on the “S” and the votes that are perceived to come with it.

“When a big employer lays off a hundred workers, the picture tells the story,” Tony Smith, Coalition member for the federal seat of Casey, says.

“When 100 [medium] businesses each hire an additional employee, we don’t see it. It is a story that cannot be summed up in a single picture.”

This image problem means the specific concerns of mid-market companies have not been widely documented or understood. Nor has their been much appreciation for their outsized economic power (see graphic).

A Google search for “mid market Australia” brings up mainly links to a “Mid Market Report” commissioned annually for the last four years by financier GE Capital, which has partnered with BRW (published by Fairfax) to champion the sector’s stories and special needs.

However, the search engine may soon have more to play with, as the likes of Smith, who also chairs the Coalition’s Backbench Economics and Finance Policy Committee, specifically address the sector.

“I’ve got mid-sized businesses in my electorate, everything from the suburban accountant to producers in the Yarra Valley, and I know the issues they face,” he says. “They had 20 staff, they grow and all of a sudden they’ve got 80 staff, and maintaining what made them successful can be a challenge.”

Going on the record

The management training they require could be available under the Entrepreneur’s Infrastructure Program launched by the Coalition this year. Smith would also like to see a panel appointed to create tools for mid-market executives, such as template prospectuses to make staff share schemes easier to implement.

Get broader recognition of the mid-market, and better policy settings will flow toward it, says Aaron Baxter, the managing director of corporate & commercial finance at GE Capital.

“The starting point is an acknowledgment of the mid-market’s size,” says Baxter, whose firm works with about a quarter of Australia’s mid-market .

Mid-market businesses tend to be large enough to operate in more than one Australian state, Baxter points out, so efforts to harmonise rules around things like payroll taxes and worker’s compensation would immediately make life much easier for them.

There’s a better chance such specific requirements will be better understood after the University of New South Wales’ Australian Graduate School of Management (AGSM), with GE Capital’s help, secured in July a $350,000 grant for world-first research in to the sector.

The AGSM’s Julie Cogin hopes the grant may be the first of more targeted at the mid-market.

“There’s much that to be done on leadership development education for this sector,” she says.

Family businesses

Many mid-market companies are in reality just very successful family businesses, Cogin points out, and some could use assistance to put corporate processes in place, without upsetting the agility upon which their success was based.

“Building good forecasting technology – or knowing where to buy it in – is crucial for mid-market companies to take full advantage of their nimbleness,” she says.

Better human resources management would be another useful subject for training grants, says GE Capital’s director of communications, Anthony Spargo. “The mid-market has an issue with talent management. The big guys tend to come in and pluck the people the mid-market has trained up, because they can pay more money,” he says.

However, mid-sized businesses need to appreciate they can offer something more than money.

“They need to learn how to make employees feel like owners. The fact they tend to have less bureaucracy is an advantage in this regard, because staff can be more hands-on and feel they are growing a business.”

Of course, if the Coalition comes through on its promise to reform employee share option schemes, more mid-market companies will be able to not merely make staff feel like owners, but actually make them owners.

“This helps solve the succession issue that a lot of mid-market companies face,” adds Tony Smith.

Not that the mid-market will ever get everything it wants.

A major gripe for many executives in the sector, given its large representation of companies from the service industry, is excessive penalty wage rates on Sundays and public holidays.

“I feel like government really doesn’t understand the challenges we face on this,” says Andrew Dyduk, co-founder with brother Tom of the Schnitz restaurant chain. “It’s important to give continuity to our customers and open on Sundays, but we do feel like we get penalised on the days we should be making money.”

Nevertheless, the government’s Senate leader, Eric Abetz, last month ruled out any changes to penalty rates.

Niggles aside, mid-market companies tend to be far more interested in helping themselves than waiting for favourable decisions from government.

For Schnitz, that means “taking this fast casual schnitzel niche we’ve created” into a planned 60 countries beyond Australia.

For Seeley International, which already exports its locally manufactured heaters and air conditioners to 120 countries and counting, it means not hand-wringing about the closure of car manufacturing in its home town of Adelaide.

“Hopefully it will mean a lot of talented engineers will want to come and work for us – we need them,” says founder and chairman Frank Seeley.

*Original Article: http://www.brw.com.au/p/business/mid-market/finally_businesses_getting_revenue_xWPyOUCuUIe6qdevp8MZMK